The Bank of Ghana (BoG) is working on an offline version of the e-cedi digital currency that could be used for consecutive payments between individuals and merchants in the absence of connectivity infrastructure.

The innovation forms part of the bank’s commitment to promoting financial inclusion and financial digitalization programme, partnering with GD technology to pilot the issuance of a digital currency.

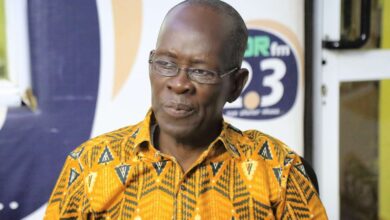

“So far, the usage and uptake of the offline version of the eCedi is being piloted in a small town called Sefwi Asafo in the Western North Region,” said Dr Ernest Addison, the BOG Governor, at the 6th CEO Summit in Accra on Monday.

Speaking on the theme: “Digital Leadership for a Digital Economy”, Dr Ernest Addison said digitising the offline transactions of rural and frontier households held the key to creating the necessary market linkages that could result in access to finance in future.

He said that the Bank would work with users to obtain the critical usage data that would inform the decision about the future of the digital currency after the pilot.

Over the past two decades, the Central Bank has been at the forefront of the country’s digitisation agenda.

This started with the passage of the Payment Systems Act 2003 (Act 662), which provided the legal and regulatory basis for the introduction of technology in the banking industry.

This was followed with the implementation of a real-time gross settlement system, which is the Ghana Interbank Settlement (GIS) system.

The infrastructure significantly improved the efficiency of wholesale and large-value interbank funds transfer and liquidity management.

In 2007, additional institutional reforms were carried out which led to the establishment of the Ghana Interbank Payment and Settlement Systems Limited (GhIPSS).

Since then, GhIPSS has rapidly transformed the payment ecosystem through the implementation of interoperable interbank retail payment systems, including electronic cheque clearing, Automated Clearing House for direct debit and credit funds transfer, instant payment, Gh-Link card, and mobile money interoperability.

The Bank reinforced the regulatory frameworks to tackle financial exclusion in a practical and affordable manner.

This led to the issuance of Branchless Banking Guidelines (BBG) in 2008, which provided regulatory support for mobile money through partnerships between banks and telecommunication companies.

A further review of the BBG led to the Electronic Money issuers and Agents Guideline in 2015 to address some regulatory challenges and boost adoption of the mobile money concept.

These regulatory changes provided the needed boost to the expansion of mobile money operations and set the stage for financial technology in Ghana.

The enabling regulatory environment attracted several FinTech companies into the ecosystem, who introduced innovative digital financial products and services on the back of mobile money operations.

This, notwithstanding, the operations of FinTechs were largely unregulated, and to better harness their potential, an extensive review and consolidation of laws, regulations, policies, and guidelines within the payment systems was done.

The Payment Systems and Services Act, 2019 (Act 987) was then passed which has since established a conducive environment for inclusive and competitive delivery of digital financial services.

Source : GNA