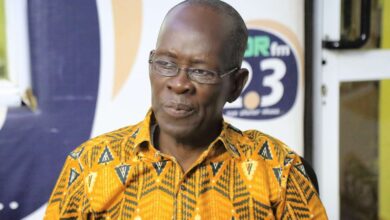

Banks have significantly reduced their borrowings from the central bank, following a marked improvement in the liquidity positions of all the 32 banks, the Governor of the Bank of Ghana, Dr Ernest Addison, has said.

The reduction in borrowing from the central bank was observed around the second and third quarters of the year, when the liquidity positions of banks started picking up, prompting them to lessen their reliance on the BoG for financial support, Dr Addison told journalists at a press conference to announce the bank’s policy rate.

Although this was the case in the early part of the year, Dr Addison said the situation had improved, especially over the past two months.

“I think that the situation has improved significantly from the beginning of the year when banks were in very serious need of liquidity,” he said in response to questions after announcing a 100 basis points cut in the policy rate.

“At least, over the last two months, we have not seen that type of pressure and so there are improvements,” he added.

At the press conference, the bank cut its prime rate to 20 per cent in line with the easing inflationary pressures observed over the last two months.

It was the fourth time in the year that the central bank had cut its prime rate, ostensibly to signal an ease in inflationary pressures and the need for banks to drop their lending rates.

Impact on lending rates

Although data on the liquidity position of the banking sector is readily not available, the interbank rate, which is interest rate charged on short-term loans among banks, has been on the decline since January.

The rate dropped from 25.2 per cent on January, 16 to 22.05 per cent on June, 16 in line with the corresponding reduction in the policy rate and the pressure on banks to borrow from their counterparts within the period.

It dropped further to 20.65 per cent on November, 27 and is now expected to normalise to below 20 per cent by December, 1 in tandem with the new policy rate.

An economic analyst with Databank, Mr Courage Kwesi Boti, said the easing pressure on banks’ liquidity could portend a gradual decline in lending rates.

“If you do not have enough reserves to meet the BoG requirement, then you have to borrow from your colleague to meet the requirement, isn’t it? However, it is possible that your colleague has more than the required probably because they have not given out so much loans, then they can lend the excess to you.

“So, if you are going to borrow to meet the minimum requirement, then the cost at which you borrow it will also influence the interest rate on the loans you will be giving out,” he said.

“Therefore, if the cost of the funds becomes lower, then your interest rates will also decline, all things being equal. But again, everything depends on the formula for working your risk earning and your risk assessment of the individual involved,” he added.

Lending rates

Although the BoG’s policy rate has gone down by 550 basis points between January and November, this year, lending rates have only seen a minimal reduction.

The industry average of the BoG’s annual percentage rate (APR), which measures interest charged on loans, declined from 27.6 per cent in January to 25.7 per cent in October.

While admitting that the response from the banking sector was modest, the central bank governor said it was largely due to the structural challenges facing the banking sector.

“The speed at which the lending rates will come down is hindered a bit by some of these structural issues in the sector, including the high level of non-performing loans (NPLs). The inefficiencies in the banking sector would have to be worked on and then we can expect that once those efficiencies are made, then we’ll see a faster transmission of the policy rate into the lending rates,” he said.

Total advances to the private sector grew from GH¢34.3 billion in October, 2016 to GH¢38.4 billion in the same period this year, representing a 12 per cent growth within the 12-month period.

Of this amount, data from the BoG showed that 21.6 per cent were NPLs – close in default or close to default. — GB