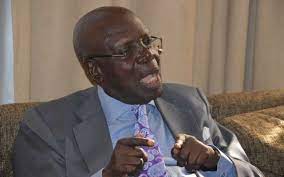

An Economist and Governance Expert, Dr Ishmael Yamson has indicated that the challenges Ghana is facing at the moment started before the outbreak of the Covid-19 pandemic and the Russia-Ukraine war.

For him, the signs were clear that Ghana’s debt situation was reaching unstainable levels before the emergence of the pandemic.

“The borrowing has been taking place before that time,” he said on the Ghana Tonight show on Monday August 22.

He added “the international capital market had concluded that we were unable to service our debts. It was not because of Covid or the Russia-Ukraine war, investor confidence had gone down because of the debts.”

Dr Yamson further asked the government to admit it has failed to act prudently, a situation which has led the country into the challenges.

“That admission for me, is important,” he stated.

“What should we do in order not to go and borrow money? Diagnose our problems better, more credibly and if you have a credible plan, people will invest in your plan.

“The government is faced with credibility crisis otherwise, why are investors refusing to lend to Ghana? Because they know we cannot pay,” he stated.

He further noted that the depreciation of the Cedi is discrediting the government.

“If your Cedi is depreciating every day, you are losing credibility,” he stressed.

Meanwhile, President Nana Addo Dankwa Akufo-Addo has assured that measures are being taken to resolve the fall of the Cedi.

Mr Akufo-Addo noted that prior to the onset of the COVID-19 pandemic, Ghana had one of the fastest growing economies not just in Africa, but across the world.

“However, the ravages of the pandemic, worsened by the effects of Russia’s invasion of Ukraine, have led to spiraling freight charges, rising fuel costs, high food prices, steep inflationary spikes and widespread business failures. I am fully aware that these are very difficult times for us in Ghana, just as they are for most people in the world, cold comfort as that may be,” he said.

One of the ways toward bringing the economy back on track, the President said, is the approach to the International Monetary Fund, which he described as an important step.

“Other steps will be taken, in particular, to deal with the unacceptable depreciation of the cedi. Reining in inflation, by bringing down food prices, is a major preoccupation of the Government, and this season’s emerging, successful harvest will assist us achieve this objective, together with other policies that are being put in place,” Mr Akufo-Addo stated when he delivered an address at the opening of the 12th Biennial and 50th Golden Conference of the Methodist Church of Ghana.

Ghana’s currency, the Cedi, has crossed ¢10 per dollar mark as of Friday August 19.

It now trades at ¢10.01 per dollar in some forex bureaus.

The Bank of Ghana (BoG) in a statement called for calm as it has introduced measures to resolve the fall of the Cedi. The BoG has identified five key reasons for the woes of the local currency.

These are “The strength of the US dollar, Investor reaction to Credit Rating Downgrade, Non-Roll over of Maturing Bonds, The sharp rise in crude oil prices and impact on the Oil Bill, Loss of External Financing.”

The measures introduced to resolve these, according to the BoG, are the “Gold Purchase Program to increase foreign exchange reserves; Special Foreign Exchange Auction for the Bulk Distribution Company’s (BDCs) to help with the importation of petroleum products; Bank of Ghana is entering into a cooperation agreement with the mining companies to provide BOG with the opportunity to buy gold as when it becomes available.

“The Bank of Ghana is supporting the banking sector with foreign currency liquidity to help meet the demand for external payments. The recently approved USD750,000,000 Afriexim loan facility by Parliament, once disbursed, will boost the foreign exchange position of the country and help restore confidence.

“The Cocoa Loan is expected in the last quarter of the year. This facility will also help provide more foreign currency to help address the cedi depreciation. In the short term, we expect that when the IMF programme is finalized, it will also go a long way to help restore confidence in the economy and drive portfolio flows.”

Disclaimer; Ahotoronline.com is not liable for any damages resulting from the use of the information

Posted by Godfred Sey