Ghana’s tax to Gross Domestic Product (GDP) of 14% is one of the lowest in West Africa with some African countries hovering around 24% and the Organization for Economic Cooperation and Development (OECD) countries recording an average of about 35%.

However, the rate of tax collection in the country is one of the lowest on the continent which has become a challenge to national development.

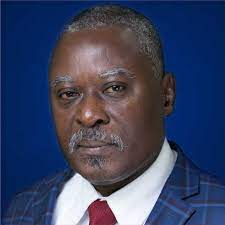

The Presidential Advisor, Yaw Osafo Marfo says, the situation has become an albatross on the State.

He explained that, govt through the tax agencies would soon come up with modalities to fully draw the private sector into the tax net.

Mr. Marfo was speaking at the 11th Annual International Tax Conference in Accra.

The Conference is under the theme, ‘Taxation and Economic Development; a review of Ghana’s policies.

The forum brought together all stakeholders in revenue mobilization and other statutory bodies from the sub region.

Mr Marfo says, govt has taken major measures to enhance domestic revenue mobilization.

Commissioner- General of the Ghana Revenue Authority, Rev. Dr. Amishaddai Owusu – Amoah suggested a means by which people could be motivated into tax complains.

He cited the tying in of the acquisition of driving license, passport, building permit, and the registration of certain documents to tax clearance certificate.

In his presentation, the Chairman of the of the Governing Council of the Institute of Taxation, Ghana, Mr. Emmanuel Obeng Asiedu noted the need to ensure maximum tax mobilization especially when the whole world economy is struggling.

Adding that, the rate of development is dependent on tax compliance.

He tasked the administration of tax agencies to be more innovative and proactive in their tax mobilization activities especially in the area of digitized marketing and trading.

Mr. Asiedu raised the need to find mechanisms that would make the payment of taxes more convenient.

President of the Chartered Institute of Taxation, Ghana Mr. George Ohene Kwatia noted the need for collaboration of stakeholders to deepen compliance and enhance revenue mobilization.

He emphasized the relationship between efficient tax mobilization and national infrastructural development which is vital to the citizens.

He also added his voice to the call to develop effective modalities in roping in the private sector in tax mobilization.

Mr Kwatia noted the lack of education in taxation in the public space and called for the inclusion of taxation in the basic academic syllabus, as well as, the Senior High School curriculum.

This, he believes would cause the nationals to appreciate the need to voluntarily pay their taxes.

Godfred Sey/ Ahotoronline.com