Organized labour has suspended its planned demonstration over the Value Added Tax (VAT) on electricity following the government’s decision to suspend the controversial tax.

Secretary General of the Trades Union Congress (TUC), Dr Anthony Yaw Baah, announced the suspension of the demonstration at a press conference in Accra on Friday, February 9.

“We gave the government to 31st January to withdraw the letter and warned authorities that if by that time the Minister of Finance had not given the directive to stop the VAT we would advise ourselves.

On 2nd February 2024, the leadership of organized labour met and we resolved that there will be a nationwide demonstration on the 13th of February. On the 7th of Febraury government announced the suspension of the implementation of VAT on electricity consumption. The leadership of organized about has received a formal letter informing us of the new directive. We will therefore like to inform our members that the planned demonstration slated for 13th February has been suspended.”

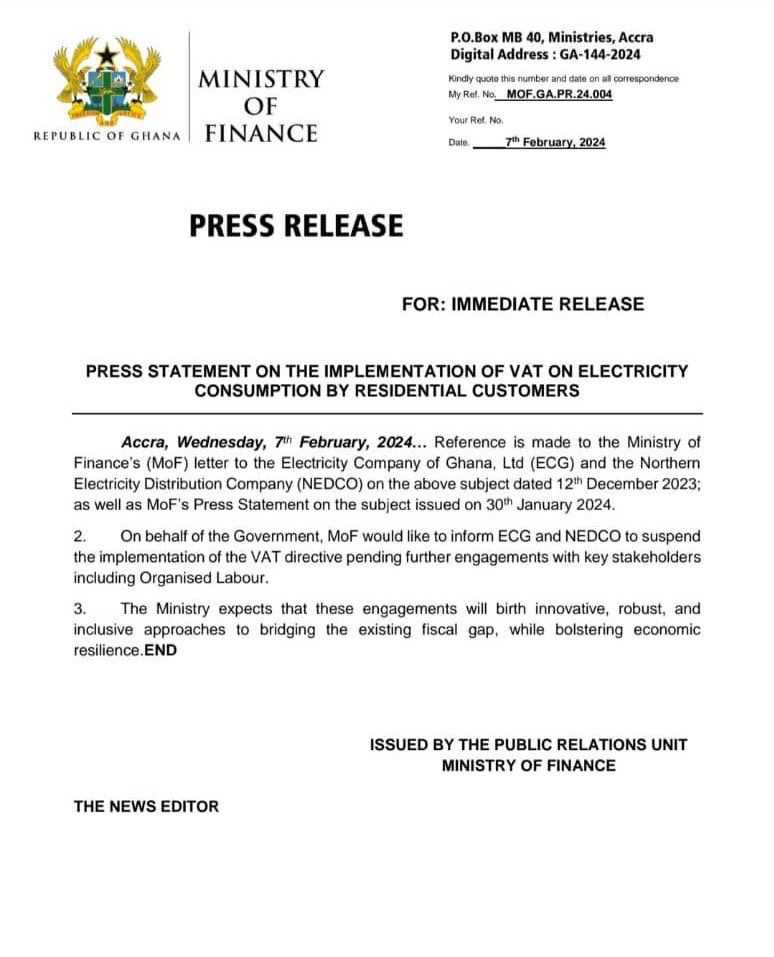

The Finance Ministry directed ECG and NEDCo to suspend the implementation of the proposed 15% VAT on electricity consumption.

The move to impose a tax on the consumption of electricity by residential customers has received stiff opposition from various quarters.

The Ministry of Finance in a statement dated February 7, 2024, has asked the two entities (ECG and NEDCo) to suspend the tax measure while government continues to hold further engagements with stakeholders.

“On behalf of the Government, MoF would like to inform ECG and NEDCO to suspend the implementation of the VAT directive pending further engagements with key stakeholders including Organised Labour,” parts of the statement read.

The Food and Beverage Association of Ghana (FABAG) also described the tax measure as ”insensitive and anti-business.”

Meanwhile, the Finance Ministry is hopeful that its pending engagements would yield positive results to bridge the fiscal gap while strengthening businesses.

“The ministry expects that these engagements will birth innovative and inclusive approaches to bridging the fiscal gap while bolstering economic resilience,” it concluded.

Read the full statement below: