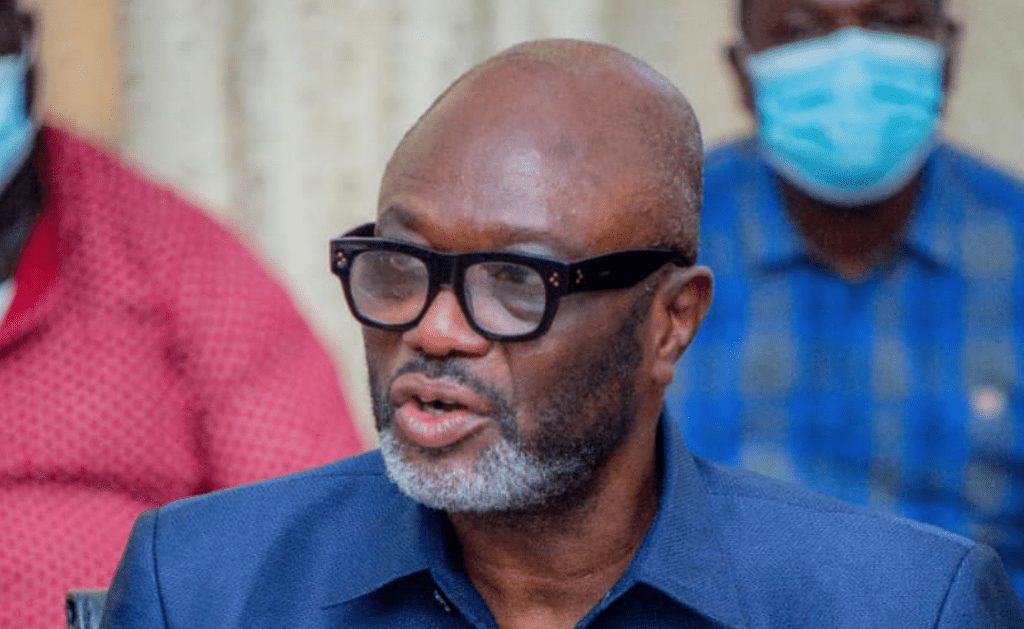

President of the Ghana Union of Traders Association (GUTA), Dr Joseph Obeng has lamented the potential effect of the recently passed tax laws on the business community.

According to him, the introduction will affect the cost of doing business in the country.

The Excise Duty and the Income Tax Amendment Acts that were passed by Parliament take effect from Monday, May 1.

Ahead of the implementation, the GUTA President says his members may be compelled to pass on the cost incurred from the taxes to consumers.

“The business that we do, we do not do in isolation, we do with the consuming public so whatever affects the business community the rippling effect goes to the consumer. As a matter of fact, it’s a cycle, whatever target is being enjoyed by one will be given to the end user and this is what is going to happen.

He further expressed his disappointment in the government for consenting to the tax bills and not heeding the Association’s calls to suspend their implementation.

He stated that due to the adverse effects the new taxes would have on businesses, it was the expectation of the Association that they would be called upon by government to discuss the bills before they were implemented.

“All that we sought was for government to engage with this so that if there could be any possible revision that we can give some respite for the businesses to grow, it would have been very helpful to businesses.”

Nonetheless, he indicated that in hopes of attaining the ‘respite’ they seek, GUTA would discuss ways to get its petition for the revision of the tax heard by the government with its stakeholders [the business community].

The Excise Duty and the Income Tax Amendment Acts that were passed by Parliament become effective from Monday, May 1.

These two taxes were passed by Parliament together with the Growth and Sustainability Act despite fierce resistance by the Minority in Parliament and the business community.

According to an implementation guideline published by the Ghana Revenue Authority, companies have been given up to the end of this month to configure their systems to accommodate the implementation of these taxes.

Disclaimer: Ahotoronline.com is not liable for any damages resulting from the use of this information

Myjoyonline