Parliament’s Finance Committee says it will drag before the House, Governor of the Bank of Ghana, Ernest Addison over the collapse of some five banks.

The recent collapse brings to seven the total number of banks that have gone under in just a year.

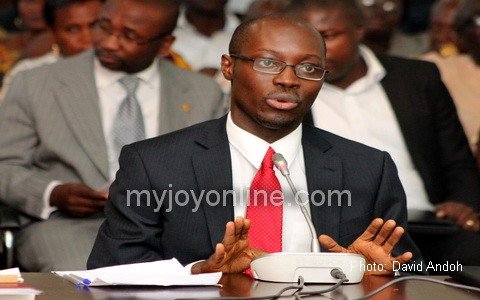

Minority spokesperson on Finance, Cassiel Ato Forson says the Finance Minister will also be brought before Parliament to explain the occurrences in the banking sector.

“I am going to ask the Minister of Finance and Governor of the Bank of Ghana to appear before Parliament to give us further and better particulars about this and if there is any way government of Ghana can take any action to reduce the fiscal cost to the state,” he said on Joy News’ political talk show programme, Upfront.

The Central Bank on Wednesday announced the creation of the Consolidated Bank Ghana Limited after it dissolved five ailing banks – Sovereign Bank, Beige Bank, uniBank, Construction Bank and The Royal Bank.

These banks according to the Governor are having liquidity challenges and efforts to keep their heads above water have yielded no fruitful results, a reason they have been consolidated.

The BoG also said its investigations have revealed that The Beige Bank, Sovereign Bank and Construction Bank obtained their banking licences illegally through the use of suspicious and non-existent capital.

Shareholders and directors of uniBank are said to have advanced GH¢5.3 billion in loans from the bank through illegal means.

But Mr Forson says the Governor and Finance Minister must be made to explain why the State is investing a whopping GH¢5.7 billion to fix the problems created by these banks.

“Because GH¢5.7 isn’t small money,” he said.

Second Deputy Governor of the BoG, Elsie Addo Awadzi says her outfit will pass on findings of the five collapsed banks for action to be taken against persons who contributed to the insolvency of the financial institutions.

Speaking on Joy FM’s Super Morning Show, she said “What happened yesterday bears testimony to the fact that this is a new day and we are building a new culture of integrity and trust within the banking sector,” Awadzi avowed.

source; myjoyonline