Implementation of the Electronic Transfer Levy also known as the E-Levy will begin on May 1, 2022, according to the GRA.

The E-Levy will impose a 1.50% levy on most electronic transfers.

This means that, from May 1, some transfers involving mobile money accounts and some specified bank transfers will be taxed.

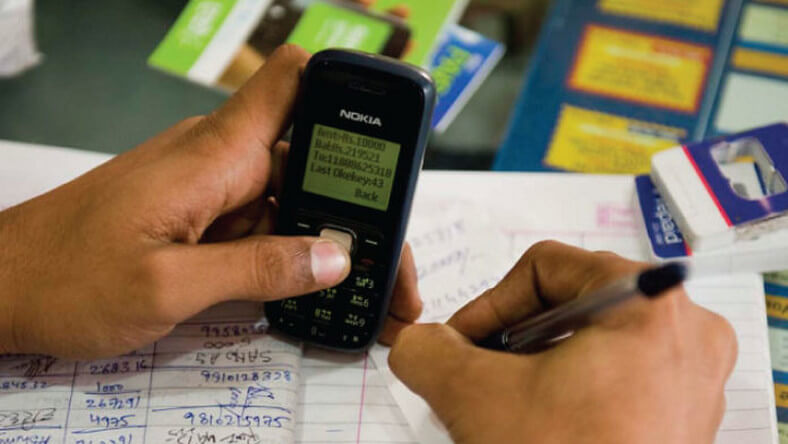

But how will you know when the implementation begins? What will be the indicators on your phone or transfer device?

This is what a member of the E-Levy Technical Committee established to ensure the smooth implementation of the E-Levy Act 1075 sought to explain when he sat with Dzifa Bampoh on the Key Points.

According to Isaac Kobina Amoako, though there will be no significant changes, notifications that usually come with the transfer of monies will include information about how much individuals will be charged for the E-Levy, per the transactions they make.

“Nothing will change drastically. What you will probably see is that, when you make a transfer, at the notification side, the telco will be communicating to you how much you are supposed to be charged, you will see a piece of extra information that will be E-Levy chargeable that is if you are doing a transaction that is taxable by E-Levy,” he said.

“You will see that information before you provide your PIN just like we currently do…..that information will show you the amount that is to be deducted,” he added.

The Electronic Transfer Levy Act, 2022, Act 1075, otherwise known as the E-Levy, was given Presidential assent on Thursday, March 31, 2022, after it was passed by Parliament on Tuesday, March 29, 2022.