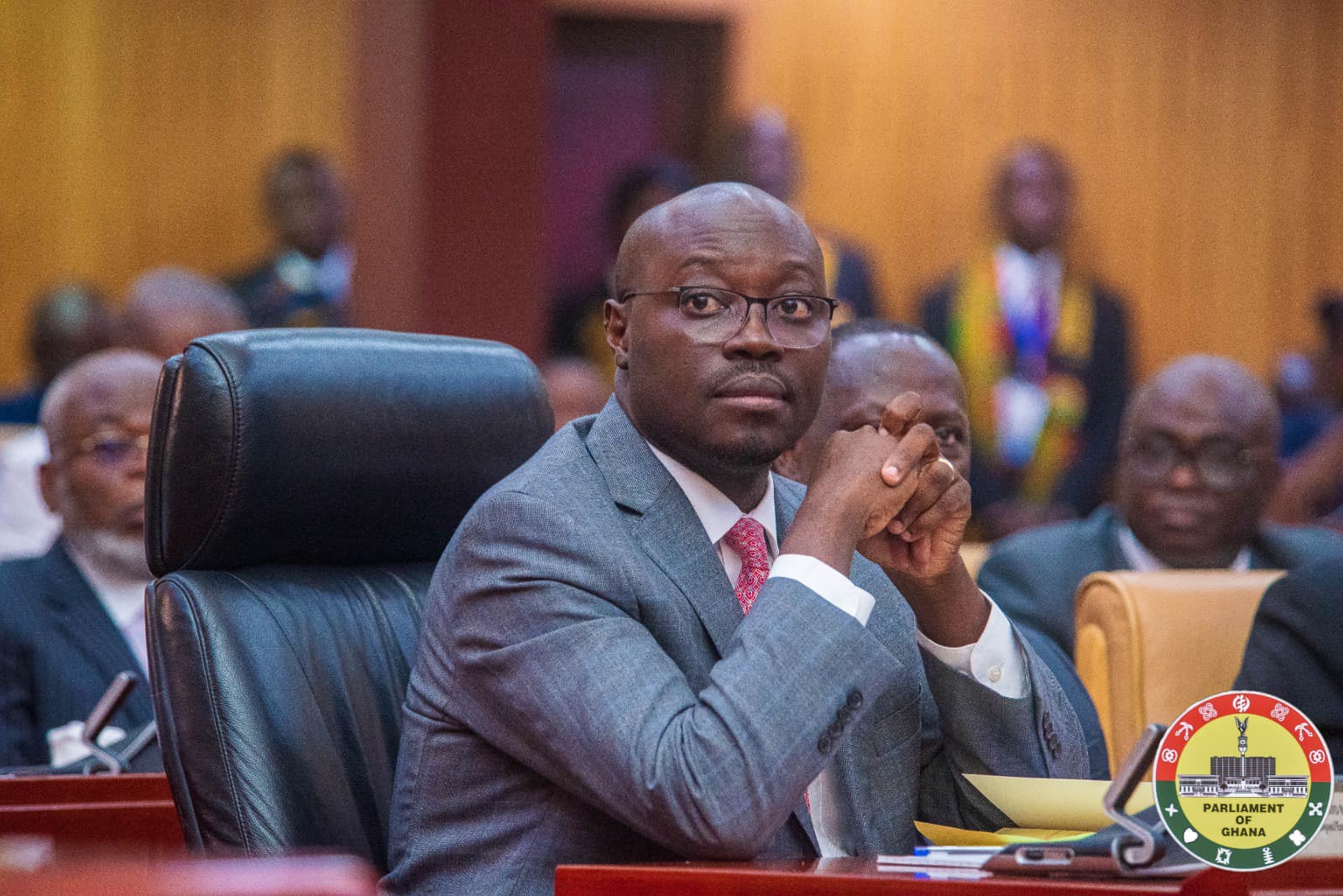

Dr. Cassiel Ato Forson, the Finance Minister-designate, has presented an ambitious plan to enhance government revenue without imposing additional taxes on Ghanaians. Speaking at his vetting before the Appointments Committee of Parliament, Dr. Forson highlighted his commitment to improving tax compliance and streamlining revenue collection processes.

“We don’t necessarily need to increase taxes to generate the revenue we need,” Dr. Forson stated confidently. “With the right systems and collaboration with the Ghana Revenue Authority (GRA), we can achieve significant gains by enhancing compliance.”

Dr. Forson outlined a clear target to improve Ghana’s tax-to-GDP ratio from the current 13% to 16%, bringing it closer to international benchmarks. He stressed that achieving this goal is critical to meeting the country’s development aspirations while avoiding the imposition of additional burdens on citizens.

A Fairer Tax System for Growth

In addition to improving compliance, Dr. Forson promised a thorough review of existing taxes to ensure fairness and equity. He revealed plans to scrap certain taxes deemed unnecessary, which he believes would provide much-needed relief to businesses and individuals. This, he noted, would create a more business-friendly environment and stimulate economic growth.

“We must create a fair tax system that not only mobilises revenue but also supports the economic activities of our citizens and businesses,” he explained. “Reducing the tax burden where necessary is an essential step toward fostering a thriving economy.”

Balancing Revenue Mobilisation with Economic Development

Dr. Forson’s vision is underpinned by a philosophy of balancing fiscal responsibility with economic vitality. He argued that sustainable revenue generation requires a focus on efficiency rather than increasing rates. By leveraging technology, improving administrative systems, and addressing loopholes in the tax regime, he believes Ghana can meet its fiscal challenges without overburdening taxpayers.

“Our strategies are designed to strengthen revenue mobilisation while creating a conducive environment for economic growth. This is how we achieve development without stifling productivity,” he affirmed.

Dr. Forson’s approach has sparked optimism among stakeholders, who see it as a practical and equitable solution to Ghana’s fiscal challenges. If approved as Finance Minister, his leadership could herald a new era of efficiency and fairness in the nation’s revenue mobilisation efforts.

Story by: Mercy Addai Turkson