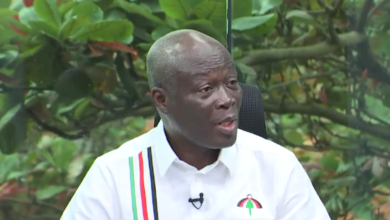

An Economist, Dr Patrick Asuming has predicted that, commercial banks will struggle to recapitalize.

According to him, this is due to the impact of the Domestic Debt Exchange Program (DDEP) on the financial sector.

His comment come at a time Rating agency, Fitch has warned that the huge loss imposed on bondholders under the program has significantly weakened Banks’ capitilisation plans.

According to the UK-based firm, the restructuring of outstanding sovereign debt and impending loan quality problems will add to capital pressures.

Meanwhile, Banks have already submitted recapitalisation plans to the Bank of Ghana after a directive was given by the central bank but, Dr Asuming says majority of banks will not be able to do so.

“Capital requirement, there will be a little bit of struggle for some of the banks. There is no two ways that the Domestic Debt Exchange Program has weakened the banks in some sense but also, you know, it’s not just what was closed in February, you know that new debt exchange is been muted by the government and we know all of this will bring further weakness into the banking system”.

Story by Nana Ama Nyamekye/Ahotoronline