The International Monetary Fund (IMF) has been confirmed as the third-largest holder of gold reserves globally, with holdings exceeding 2,814 tonnes, according to the World Gold Council’s (WGC) October 2024 report.

This makes the IMF the only organization among the top bullion holders, trailing only the United States and Germany, which lead with gold reserves of 8,133.5 tonnes and 3,351.5 tonnes, respectively.

The IMF’s substantial gold holdings reflect its historical role in the global financial system, where gold was pivotal in stabilizing exchange rates and ensuring monetary stability.

Although gold no longer underpins currencies directly, it remains a crucial asset in central bank reserves and institutional portfolios.

Globally, central banks hold a combined total of 36,320 tonnes of gold, accounting for 18.9% of the world’s international reserves.

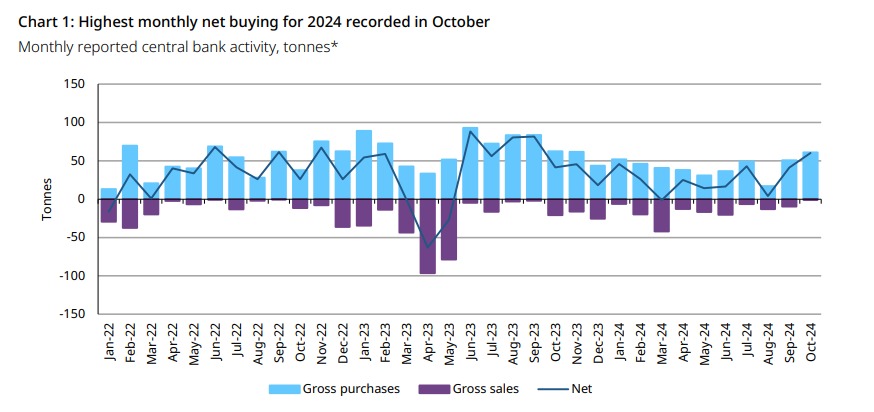

In October, central banks collectively reported 60 tonnes of net gold purchases, marking the highest monthly acquisition so far in 2024.

The Reserve Bank of India (RBI) led the monthly purchases with an addition of 27 tonnes to its reserves. Turkey followed with 17 tonnes, while Poland secured third place with an acquisition of 8 tonnes of gold.

The WGC data underscores the continued strategic importance of gold in the international financial system, with institutions and central banks leveraging bullion to bolster financial stability amidst global economic uncertainties.