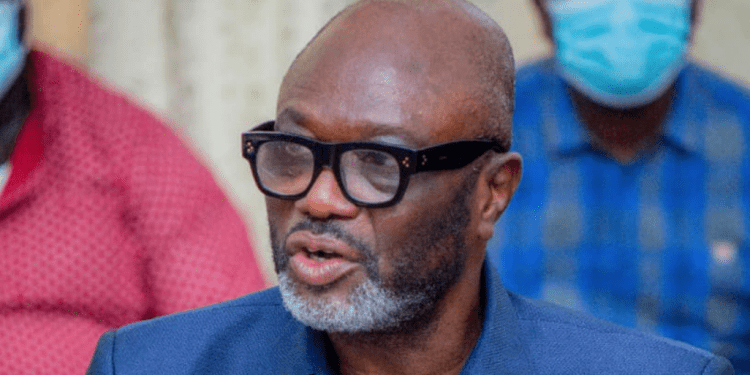

The President of the Ghana Union of Traders Association (GUTA), Dr. Joseph Obeng, has firmly expressed traders’ expectations ahead of the 2025 budget presentation by the Finance Minister, Dr. Cassiel Ato Forson. Dr. Obeng emphasized that the trading community is not prepared to accept any new taxes unless they are aimed at widening the tax net to include those currently evading tax obligations.

In his statement, Dr. Obeng said, “We’re not expecting new taxes. However, we won’t be concerned if these taxes are designed to bring in individuals or businesses that are currently outside the tax net. What we do oppose is the continuous piling of tax burdens on the few of us who already pay.”

He further urged the government to adopt innovative measures to ensure equitable taxation, highlighting that an expanded tax net would not only reduce the pressure on compliant taxpayers but also increase national revenue.

Government Prepares for 2025 Fiscal Policy

The Ghanaian government has finalized the 2025 fiscal policy document, set to be presented to Parliament on March 11. This significant step, taken during a special Cabinet meeting on Thursday, underscores the administration’s resolve to stabilize the economy and foster sustainable growth.

Minister of Government Communications, Felix Kwakye Ofosu, provided insights into the budget after the Cabinet meeting. He reassured citizens that the fiscal policy would honor the government’s commitment to addressing pressing social and economic challenges.

“We remain dedicated to fulfilling the promises made within our first 120 days, including the removal of the betting tax and the COVID levy,” Kwakye Ofosu stated.

He added that the budget would not only reflect the economic realities inherited by the National Democratic Congress (NDC) government but also chart a path toward recovery and national development. The plan is expected to feature pragmatic strategies aimed at fostering economic resilience while prioritizing inclusivity.

Traders Await Government Action

GUTA’s call for a more inclusive tax policy resonates with the broader business community, which has often criticized the over-reliance on a small taxpaying base. As the 2025 budget looms, many Ghanaians will be watching to see how the government balances revenue generation with fairness and economic growth.

With the promise of transparency and strategic reforms, the 2025 budget could mark a turning point for Ghana’s fiscal landscape. However, the government’s ability to deliver on these promises will be crucial to restoring trust and confidence among businesses and the public alike.

Story by: Mercy Addai Turkson #ahotoronline.com