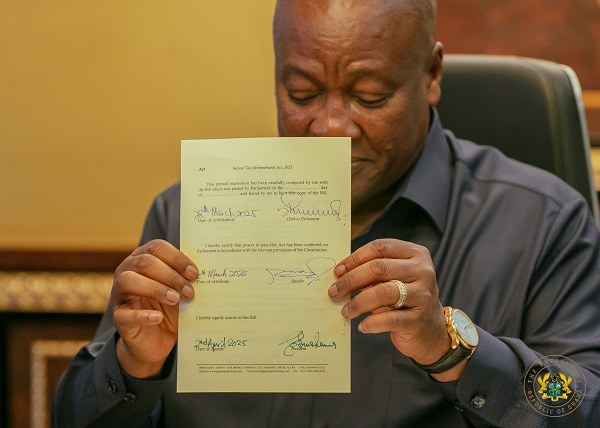

The Ghana Revenue Authority (GRA) has officially announced the abolition of the Electronic Transfer Levy (E-Levy), effective from midnight on April 2, 2025. This follows President John Mahama’s assent to a bill passed by Parliament earlier in the day, sealing the end of the much-debated tax on electronic transactions.

In a formal communication to charging entities, the GRA stated: “We wish to inform you that the President of the Republic of Ghana has assented to the Electronic Transfer Levy Act, 2022 (Act 1075) and the Electronic Transfer Levy (Amendment) Act, 2022 (Act 1089), effectively abolishing the 1% E-Levy. This policy takes effect from April 2, 2025.”

Implementation Guidelines

To ensure a smooth transition, the GRA has issued the following directives:

1. Automatic System Update: The GRA’s Electronic Transfer Levy Management and Assurance System (ELMAS) will automatically return a “no charge” response on all transactions processed after midnight.

2. Cessation of Levy Charges: All charging entities must immediately discontinue the application of the 1% E-Levy on all electronic transactions across their platforms.

3. Refunds for Deductions: Entities must promptly refund any E-Levy deductions made on transactions from April 2, 2025, onwards. A structured refund mechanism should be put in place to ensure efficiency and transparency, with proper documentation submitted to the GRA.

4. Final Settlements: Charging entities are required to file and remit all outstanding E-Levy collections on transactions completed before April 2, 2025, to the GRA.

Telecom Sector Ready for Compliance

In response to the directive, the Chief Executive Officer of the Ghana Chamber of Telecommunications, Dr. Ken Ashigbey, assured the public that telecommunications companies and other financial institutions are prepared to implement the zero-percent levy in compliance with the GRA’s mandate.

“We have had a meeting with the GRA, and although the notice is short, the Electronic Money Issuers (EMIs) are working tirelessly to ensure that by midnight, when the GRA sets ELMAS to zero, we will also align our systems accordingly. By morning, users should see no E-Levy charges on their mobile money transactions,” Dr. Ashigbey explained in an interview.

Addressing Potential Concerns

Dr. Ashigbey reassured the public that in cases where any deductions occur inadvertently, there is no cause for alarm.

“If any E-Levy charge is mistakenly applied due to the short transition period, the charging entity will bear full responsibility for issuing refunds. No E-Levy deductions will be transferred to the Consolidated Fund,” he emphasized.

The removal of the E-Levy marks a significant policy shift in Ghana’s digital financial space, aiming to ease the burden on electronic transactions and enhance financial inclusion. As the country moves into this new phase, all stakeholders are expected to comply with the new tax regime seamlessly.

Story by: Mercy Addai Turkson #ahotoronline.com