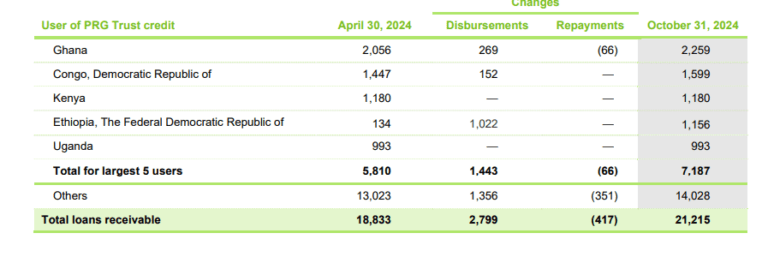

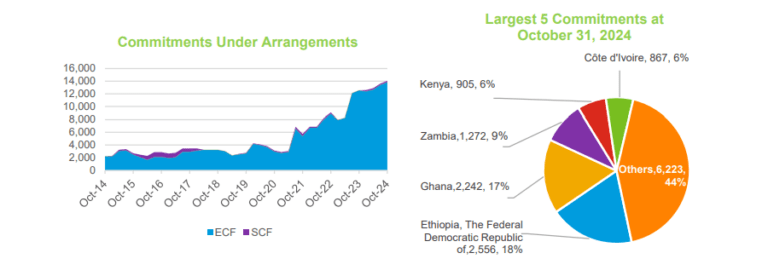

Ghana has emerged as the second most indebted African country to the International Monetary Fund (IMF) in terms of concessional loans, according to the IMF’s latest Quarterly Finances report. As of October 31, 2024, Ghana’s outstanding loans to the IMF stood at $2.914 billion, accounting for 17% of total African borrowings from the institution.

The Democratic Republic of Congo (DRC) leads the list with an indebtedness of $2.256 billion in Special Drawing Rights (SDRs), while Zambia follows Ghana in third place, with $1.272 billion in outstanding loans.

This ranking underscores Ghana’s continued financial challenges as the country navigates a severe economic crisis. In January 2023, Ghana sought a $3 billion bailout from the IMF under the Economic Credit Facility (ECF) program to stabilize its ailing economy. To date, it has received $1.92 billion of the agreed funds.

Concessional Lending: Lifeline for Low-Income Economies

Concessional lending refers to loans provided by the IMF at favorable terms, including low-interest rates and extended repayment periods. These loans aim to support economic development, alleviate poverty, and restore macroeconomic stability in low-income countries.

Despite these intentions, Ghana’s reliance on such loans highlights the depth of its financial struggles. Both Ghana and Zambia have defaulted on several international financial obligations, compelling them to seek IMF assistance to manage their debt burdens and revive their economies.

Economic Challenges and Rising Debt

Ghana’s mounting debt is a reflection of broader economic difficulties, including inflationary pressures, depreciating currency value, and a heavy reliance on imports. These challenges have strained public finances and undermined investor confidence, exacerbating the country’s dependency on international assistance.

As Ghana works to implement structural reforms under the IMF program, questions remain about the sustainability of its economic recovery and the long-term impact of rising external debt. This latest revelation serves as a stark reminder of the precarious state of public finances in many African nations and the critical role of the IMF in addressing these crises.

Moving forward, the government will need to strike a delicate balance between implementing reforms, stimulating economic growth, and managing the socio-economic impact of austerity measures to reduce its reliance on external debt.

Story by: Mercy Addai Turkson