This is according to the 2017 audit report released by the Auditor General, Daniel Domelevo.

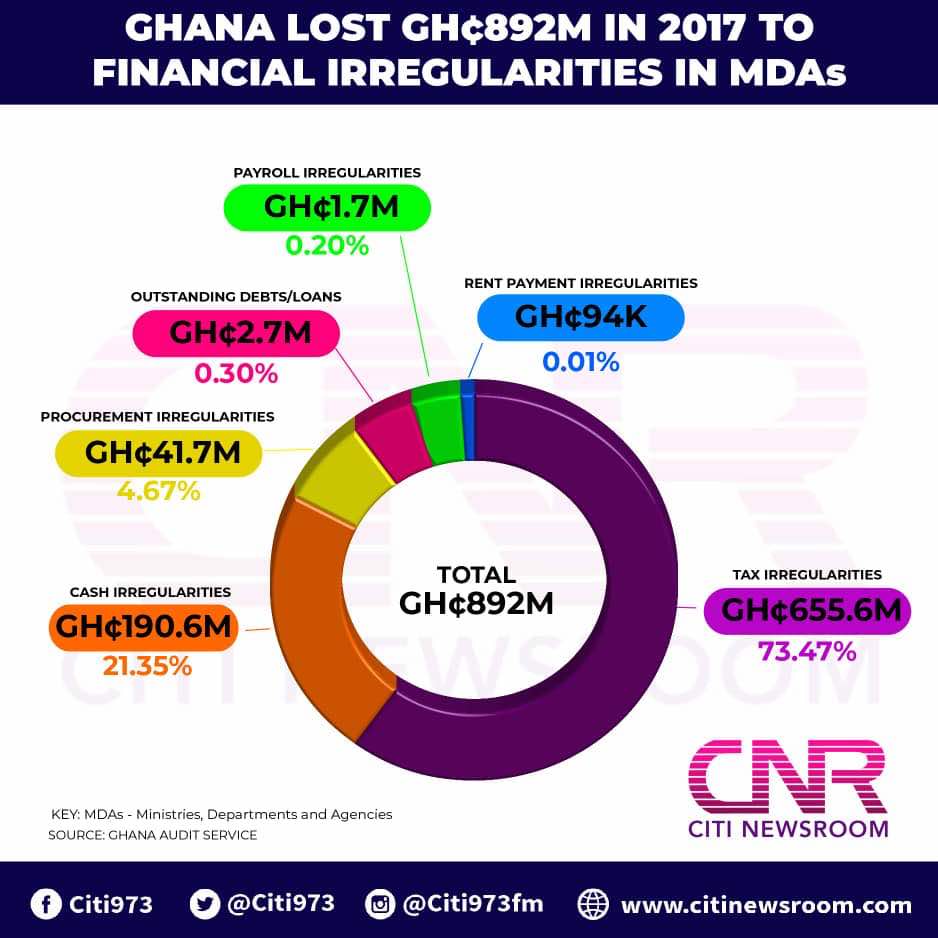

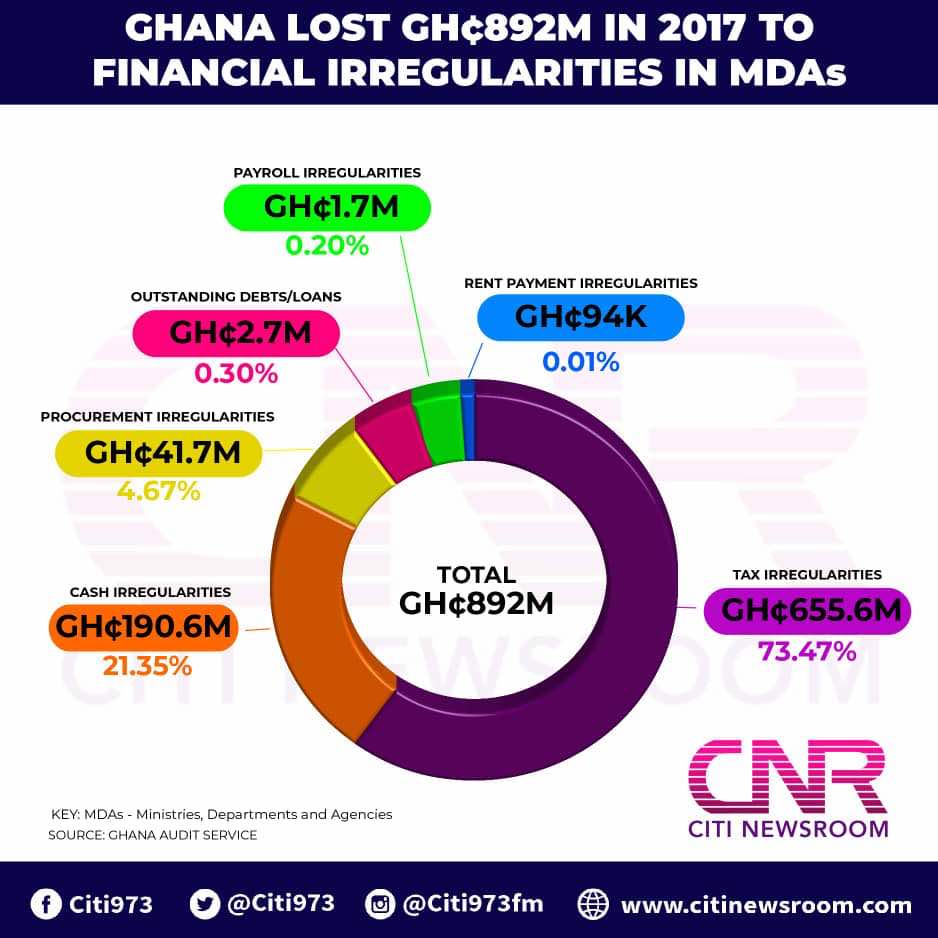

The overall financial impact of weaknesses and irregularities identified in the course of the audit amounted to GH¢892,396,375.19.

Financial weaknesses and other irregularities in the report are summarised under six broad categories namely; Tax Irregularities, Cash Irregularities, Stores/Procurement Irregularities, Outstanding debts/loans, Payroll Irregularities and Rent payment Irregularities.

According to Mr. Domelevo, “The irregularities represent either losses that had been incurred by the State through the impropriety or lack of probity in the actions and decisions of public officers or on the other hand, the savings that could have been made, if public officials and institutions had duly observed the public financial management framework put in place to guide their conduct and also safeguard national assets and resources”.

Tax irregularities amounting to GH¢655.6million represents 73% of the losses recorded in 2017.

The infographic below provides a breakdown of the losses in the MDAs according to the report.

source, citifmonline