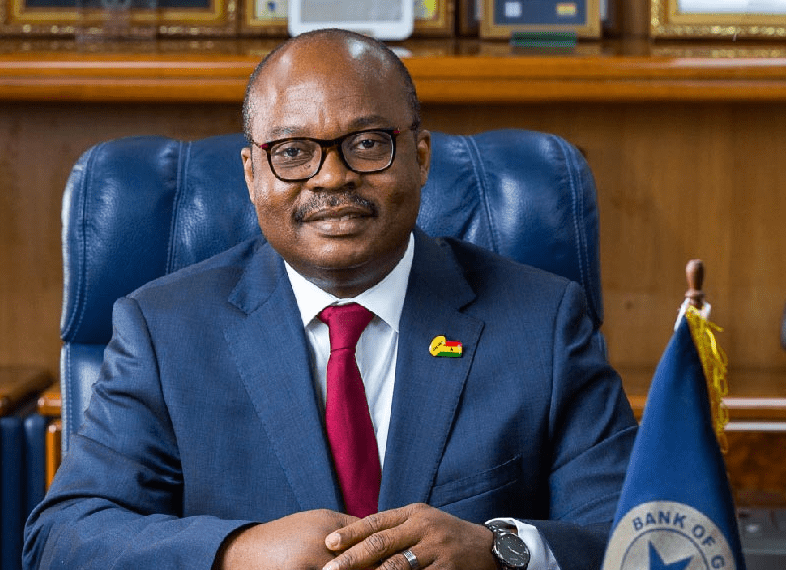

The former Governor of the Bank of Ghana (BoG), Dr. Ernest Addison and the institution he once led are facing legal action over what a private citizen describes as record exchange rate losses incurred by the Ghanaian Cedi since 2017.

Balbir Violet Allan, an investor in government treasuries, has filed a suit at the High Court, alleging that her purchasing power and investment returns suffered severe setbacks due to the depreciation of the cedi. She claims that under Dr. Addison’s tenure, the currency’s value plummeted from 4.26 GHS to 1 USD in 2017 to a staggering 15.49 GHS to 1 USD by February 2025.

The Plaintiff’s Case

The lawsuit, filed by Ms. Allan and led by legal counsel Dr. John Baiden accuses the Bank of Ghana and Dr. Addison of gross negligence in managing the currency. The plaintiff contends that the BoG, by its mandate, is responsible for stabilizing the cedi. Instead, she argues that the institution failed to implement sound monetary policies to curb the currency’s rapid depreciation during Dr. Addison’s leadership.

Ms. Allan asserts that the cedi’s depreciation under Dr. Addison’s stewardship rendered it one of the worst-performing currencies globally. She highlights that this decline significantly eroded her purchasing power, inflicted substantial exchange rate losses, and diminished her investment capital.

Her suit further alleges that Dr. Addison failed to exercise reasonable care and diligence in his management of the central bank, leading to what she calls “avoidable and record-breaking losses.”

Reliefs Sought

The plaintiff is asking the High Court to:

1. Declare that the Bank of Ghana, under Dr. Addison’s leadership was grossly negligent in its management of the Ghanaian currency.

2. Recognize the exchange rate losses she suffered as enforceable claims against both the Bank of Ghana and Dr. Ernest Addison.

Background

Dr. Addison, who served as the Governor of the Bank of Ghana from 2017 until his terminal leave in February 2025, oversaw significant financial reforms and monetary policies. However, his tenure has also been criticized for the cedi’s steep depreciation, which many analysts attribute to a mix of external economic shocks and domestic policy challenges.

This case, if successful, could set a precedent, holding public institutions and their leaders accountable for economic mismanagement with direct consequences for individual investors. The lawsuit also adds to growing public discourse about the Bank of Ghana’s role in stabilizing the national economy amid turbulent global financial conditions.

As the case unfolds, it promises to be a landmark moment in the intersection of law, finance, and public accountability in Ghana.

Story by: Mercy Addai Turkson #ahotoronline.com