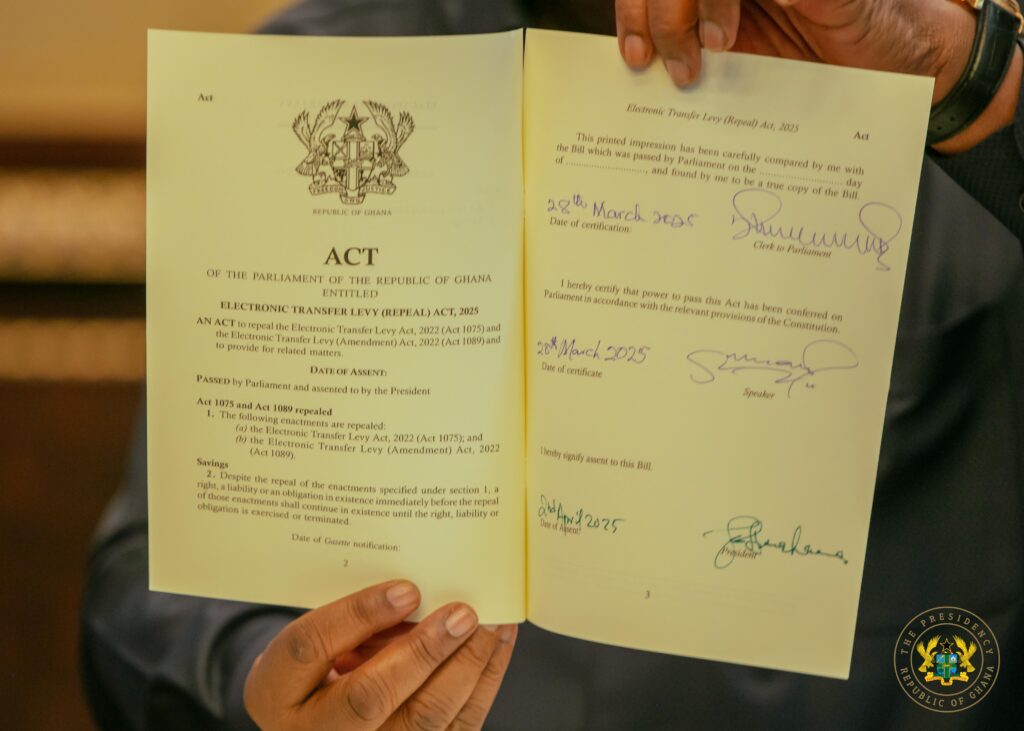

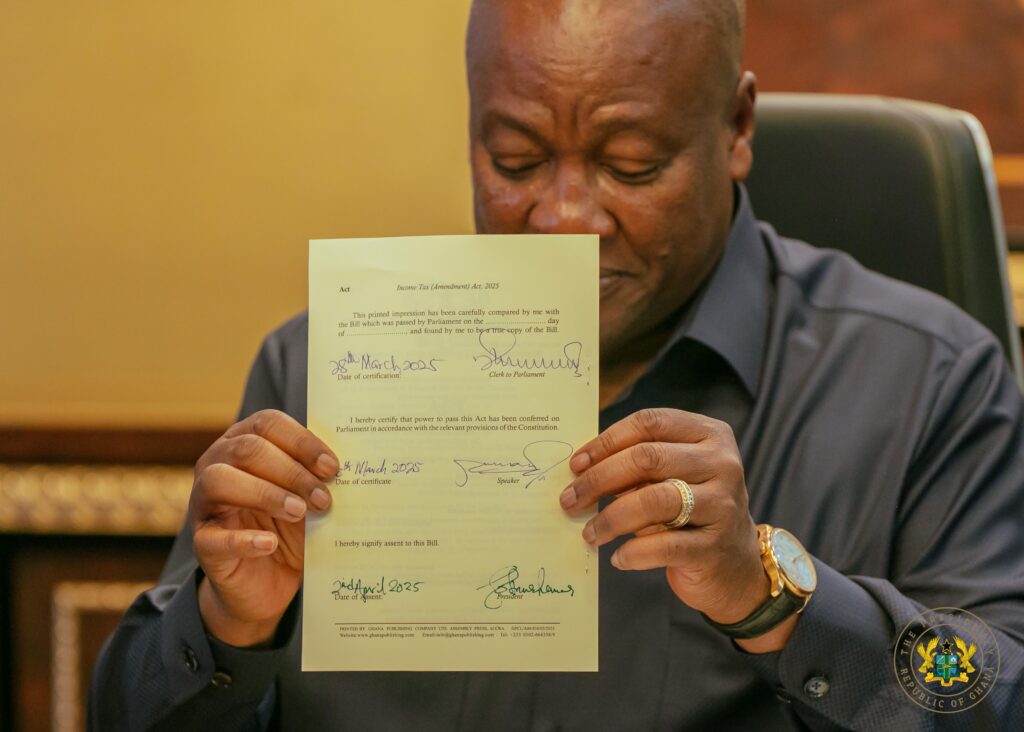

Accra, Ghana – His Excellency John Dramani Mahama, President of the Republic of Ghana, on Wednesday, April 2, 2025, officially assented to a set of amended bills, marking a significant milestone in his administration’s commitment to tax reform.

On March 13, 2025, Finance Minister Dr. Cassiel Ato Forson presented some bills to Parliament, aimed at repealing and amending various taxes and levies that had been a source of public concern. These included:

– Electronic Transfer Levy (Repeal) Bill, 2025

– Emissions Levy (Repeal) Bill, 2025

– Income Tax (Amendment) Bill, 2025

– Earmarked Funds Capping and Realignment (Amendment) Bill, 2025, among others.

Background on the Repealed Taxes

The Electronic Transfer Levy (E-Levy), introduced in 2022, imposed a 1% charge on electronic transactions, including mobile money transfers and online payments.

However, it faced widespread public opposition due to its impact on disposable incomes and financial inclusion.

Similarly, the Betting Tax, which levied a 10% charge on gross winnings from gambling activities, was met with strong resistance from stakeholders in the gaming industry, who argued it stifled the sector’s growth.

Fulfilling an Electoral Promise

During his 2024 presidential campaign, then-flagbearer of the National Democratic Congress (NDC), John Dramani Mahama, pledged to abolish these taxes within his first 120 days in office if elected.

His assent to these bills now delivers on that promise, reinforcing the NDC’s commitment to alleviating financial burdens on Ghanaians and fostering economic growth.

The signing ceremony took place at Jubilee House, the Office of the President, in the presence of key government officials, lawmakers, and stakeholders.

Pictures below:

Story by: Emmanuel Romeo Tetteh(#RomeoWrites