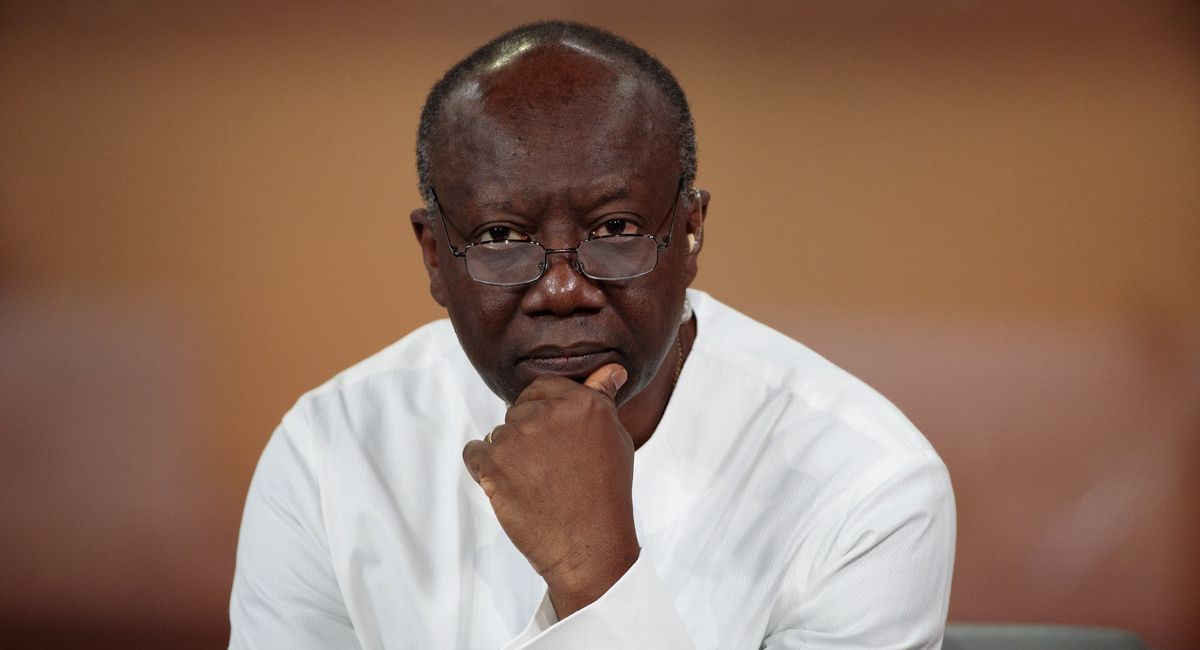

On Wednesday, November 15, the Minister for Finance, Ken Ofori-Atta, will present the 2024 Budget Statement and Economic Policy of the government to Parliament of Ghana.

This presentation aims to outline the government’s strategies for revenue generation and policies to alleviate the current economic challenges faced by Ghanaians.

The speaker Alban Sumana Kingsford Bagbin, in his announcement on Tuesday, October 31, highlighted the importance of scrutinizing the budget to ensure it addresses the needs of all Ghanaians. He emphasised the need for a consultative and consensus-building approach during the process.

A significant majority of businesses sampled in a survey says they want some key taxes handles reviewed by government.

A study put together by an audit firm KPMG revealed businesses have this year been severely impacted by the cedi depreciation and inflation. This comes in the wake the finance minister, Ken Ofori Atta is expected to present to parliament the budget estimate for next year.

Businesses sampled in the survey say their operations were significantly impacted by the cedi depreciation, inflation and high interest rate.

Notable challenges highlighted include power supply, access to capital and skilled labour. On the tax environment 89% reported adverse impact of tax on their operations. 76% wanted the government to scrap the E¬-levy while 68%want the review of the Covid 19 recovery fund.

A significant 68% also want the review of import tax. The finance minister is expected to appear in parliament to brief the house on the budgetary estimate for the year 2024.

Kaakyire Nyamekye Danso

Email: elizabethgyebi215@gmail.com