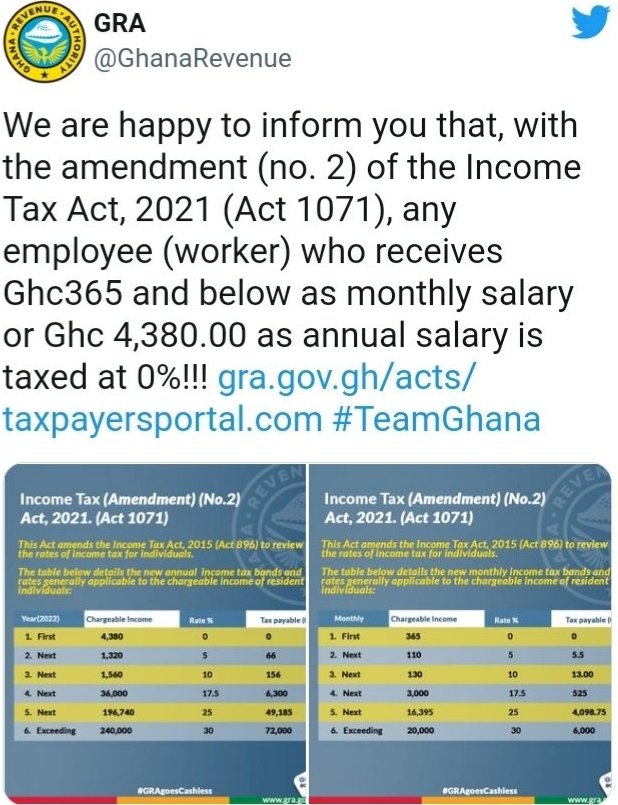

The Ghana Revenue Authority (GRA) has stated that employees who earn GH¢365 and below as monthly salary or GH¢4,380 as annual salary will not be taxed.

The Authority in a tweet explained that the decision is pursuant to Income Tax (Amendment) (No. 2) Act 2021. (Act 1071).

The GRA said the Act is “to amend the Income Tax Act, 2015 (Act 896) to review the rates of income tax for individuals; to reduce the withholding tax rate for sale of unprocessed gold by small scale miners; to increase the threshold for an individual to whom the presumptive tax under the Modified Taxation Scheme applies; to extend the Covid-19 concessions granted in 2021 for further six months in 2022 and to provide for related matters.”

The Act was assented to by the President on December 30, 2021, after it was passed by Parliament.

In June last year, the National Tripartite Committee announced that the National Minimum Daily Wage will be revised to GH¢13.53 effective January 1, 2022.

Below is the Income Tax (Amendment) (No. 2) Act 2021. (Act 1071).