The significant volume of capital flight remains a major contributing factor to the depreciation of the cedi. Approximately 80% of this phenomenon can be attributed to imports and consumables, managed predominantly by foreign companies that repatriate their profits to their home countries.

Meanwhile, local businesses and industrial competitors, comprising the remaining 20%, struggle to cope with the high interest rates on bank loans, exacerbating the cedi’s depreciation in the economy.

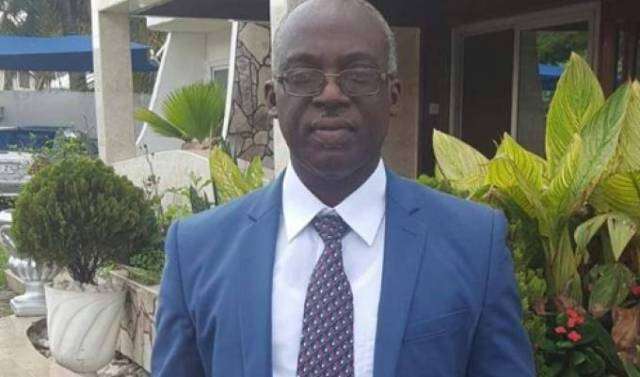

Benjamin Yeboah, the National Welfare Officer of the Ghana Union Traders’ Association, shared these insights on the Adekyee Mu Nsem morning show on Ahotor 92.3 FM, hosted by Citizen Kofi Owusu in Accra.

Yeboah emphasized that the depreciation of the cedi is not a new economic challenge for the country. Despite prior government engagements with GUTA executives outlining strategies to control capital flight and support local businesses, tangible results have been elusive.

The prevalence of imports significantly outweighs local production, particularly in consumables, due to a strong preference for foreign goods. This preference places immense pressure on the cedi.

Additionally, the Ghana Union of Traders Association (GUTA) has expressed frustration over the continued presence of foreigners in Ghana’s retail market, despite measures implemented in 2021 to protect local industries yielding no discernible results.

According to Yeboah, GUTA members are growing increasingly impatient, with some even considering taking matters into their own hands. Despite efforts to calm tensions, members are alarmed by the apparent decline of their businesses.

Previous actions by GUTA primarily targeted the Nigeria Union of Traders Association, Ghana (NUTAG). Yeboah stated that negotiations with NUTAG have faced setbacks, notably due to challenges in obtaining data on Nigerian traders in Ghana.

Conversely, NUTAG’s president, Chukwuemeka Nnaji, attributed delays to disagreements over certain aspects of the proposed agreement, particularly regarding concessions for unregistered traders.

Looking back to 2020, the Finance Ministry established a committee to investigate the causes of the cedi’s depreciation and propose solutions. Named the FX Development Committee, its formation fulfilled a promise made by the ministry to address the issue.

Deputy Finance Minister Charles Adu Boahen emphasized that the committee’s role is complementary to the efforts of the Bank of Ghana in stabilizing the cedi against major foreign currencies, not a usurpation of its authority.

Yeboah highlighted the challenges faced by businesses and individuals in planning and implementing actions due to speculation and volatility in prices. He warned that the continued depreciation of the cedi could lead to price hikes and urged the government to address the issue promptly to avert broader economic repercussions.