The Ghana Union of Traders Association (GUTA) has strongly opposed the proposed implementation of Value Added Tax (VAT) on electricity charges and the imposition of an Emissions Levy.

GUTA believes that the introduction of these additional costs will burden businesses, exacerbating the already high cost of doing business in the country.

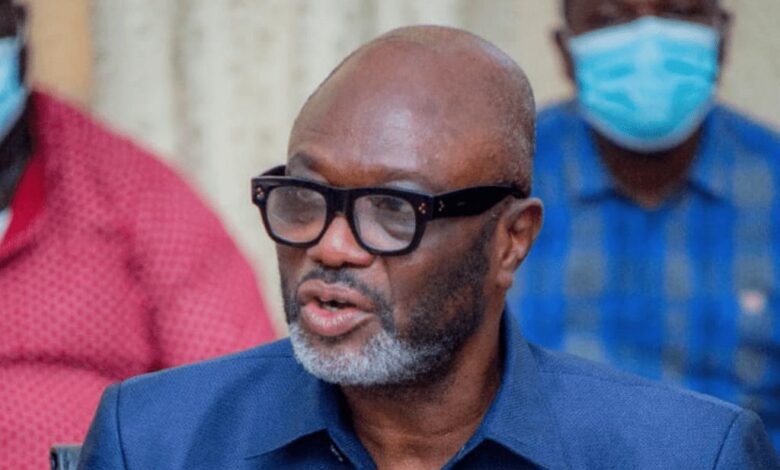

In a statement signed by its President, Dr. Joseph Obeng, GUTA said, “The Ghana Union of Traders Association (GUTA) strongly opposes the proposed implementation of Value Added Tax (VAT) on electricity charges and the imposition of an emission levy, due to the detrimental economic consequences it will have on businesses operating in Ghana.”

“GUTA firmly believes that the introduction of these additional costs will burden businesses, exacerbating the already high cost of doing business in the country.”

GUTA also added that the implementation of the emissions levy will further compound challenges due to the lack of electric vehicle infrastructure.

It suggested that the government reconsider these taxes and engage in thorough consultations with key stakeholders, including the business community.

“GUTA urges the government to reconsider these measures and engage in thorough consultations with key stakeholders, including the business community, before implementing any new taxation policies. It is crucial that the voices and concerns of businesses are heard and taken into account to ensure policies that do not hinder economic growth and investment. GUTA encourages the government to explore alternative means of revenue generation that do not place undue burdens on businesses.”

The government, on February 1, 2024, introduced a new tax policy on carbon dioxide equivalent emissions on internal combustion engine vehicles.

Stakeholders, including the Ghana Private Road Transport Union (GPRTU), have kicked against the move by the government.

In a letter dated January 1, Finance Minister Ken Ofori-Atta directed the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO) to implement the VAT, aiming to raise revenue for the COVID-19 recovery program.

Read below the statement by GUTA

4th February 2023

FROM;

GHANA UNION OF TRADERS’ ASSOCIATION

FOR IMMEDIATE RELEASE

GUTA Opposes VAT on Electricity Charges and Emission Levy, Citing Adverse Economic Impact

The Ghana Union of Traders Association (GUTA) strongly opposes the proposed implementation of Value Added Tax (VAT) on electricity charges and the imposition of an emission levy, due to the detrimental economic consequences it will have on businesses operating in Ghana.

GUTA firmly believes that the introduction of these additional costs will burden businesses, exacerbating the already high cost of doing business in the country.

The proposed VAT on electricity charges will directly impact businesses, particularly those heavily reliant on electricity for their operations. Such businesses will face increased financial strain, which could potentially lead to reduced production capacity, layoffs, and even business closures and ultimately impede economic progress and dampen job creation opportunities.

Furthermore, the implementation of the emission levy will further compound challenges in terms of double taxation and lack of electric vehicles infrastructure like charging stations and reliable source of power.

Ghana already collects energy taxes, including petroleum tax on gasoline, diesel, kerosene and LPG.

GUTA urges the government to reconsider these measures and engage in thorough consultations with key stakeholders, including the business community, before implementing any new taxation policies. It is crucial that the voices and concerns of businesses are heard and taken into account to ensure policies that do not hinder economic growth and investment.

GUTA encourages the government to explore alternative means of revenue generation that do not place undue burdens on businesses,

Signed by

Dr. Joseph Obeng

[President]Disclaimer: Ahotoronline.com is not liable for any damages resulting from the use of this information

GNA