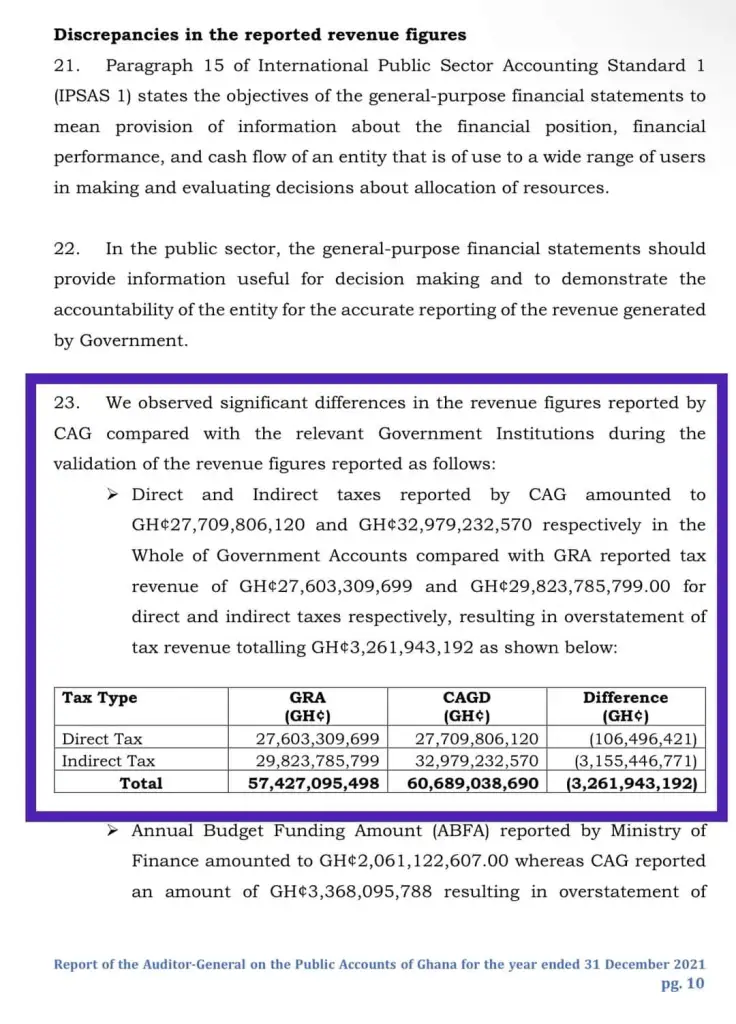

The Auditor General has discovered an amount of GH¢3.26 billion of tax revenue missing from the government account after a joined audit and reconciliation of the books of the Ministry of Finance, Ghana Revenue Authority(GRA) and the Controller and Accountant General’s Department (CAGD).

Blowing the alarm, the Auditor-General discovered that whereas the GRA and Finance Ministry reported a total tax revenue of GH¢57.43 billion, the records of CAGD indicates a total tax revenue of GH¢60.69 billion.

This indicates that over 3Billion Ghana Cedis is unaccounted for between these institutions.

A think tank, the Center for Socioeconomic Studies CSS believes this is a matter of grave concern.

“Between GRA/Ministry of Finance reports and CAGD records, there is some GH¢3.26 billion of tax revenue missing somewhere along the line in 2021. Who is actually understating or overstating the revenue figures for 2021?”CSS asked.

While GRA and Finance Ministry reported a total tax revenue of GH¢57.43 billion, the records of CAGD indicates a total tax revenue of GH¢60.69 billion. A difference of GH¢3.26 billion. Now, the interesting part is why the Auditor General decided to report it as an overstatement and not an understatement. Do not forget the CAG is the “Chief Accountant” of Ghana so who is better placed to report the right figures? GRA or the “Chief Accountant” Independent checks by CSS from inside sources indicate the CAGD did their work and got their figures perfectly right. Their report was generated from collection records/reports from the GRA itself.” It added.

The 2021 Audit report has raised numerous concerns about abuse of the procurement processes and other accounting infractions that benefited individuals.

The state is estimated to have lost more than 20billion Ghana cedis to various forms of corruption and dodgy accounting.

Disclaimer: Ahotoronline.com is not liable for any damages resulting from the use of the information.