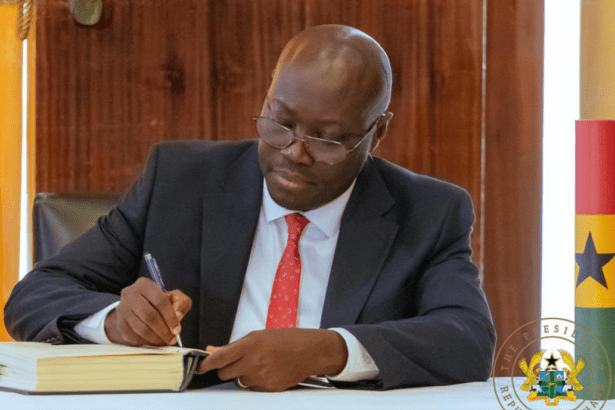

As Finance Minister Dr. Cassiel Ato Forson prepares to present the much-anticipated 2025 budget statement on Tuesday, March 10, the Institute of Progressive Governance (IPG) has emphasized the need for the budget to clearly outline how the National Democratic Congress (NDC) government will leverage technology to enhance tax administration. This, the institute stated, must be achieved without introducing any new taxes.

According to the IPG, it is imperative for the budget to address critical areas such as identifying and registering taxable persons, improving tax compliance, and streamlining the tax auditing process. These measures, they argue, are crucial for bridging Ghana’s revenue mobilization gap, ensuring accurate tax assessments, and enhancing the effective management of public resources.

Structural Reforms and Transparency

The IPG has also called for a comprehensive framework on structural reforms, particularly on the implementation of Section 88 (2)(b) of the Public Financial Management (PFM) Regulations. This regulation mandates government entities to enhance accountability and transparency in their operations. The institute underscored that these reforms are non-negotiable and should form a key component of the 2025 fiscal strategy.

Learning from the Past

Reflecting on past fiscal policies, the IPG noted the measures introduced under the New Patriotic Party’s (NPP) Post-COVID-19 Program for Economic Growth (PC-PEG). These included fiscal austerity measures such as a reduction in discretionary spending, salary cuts for top government officials, and restrictions on foreign travel and luxury vehicle use. As the NDC prepares to present its budget, the IPG expects these cost-cutting strategies to be fully incorporated and even improved upon to align with President John Mahama’s pledge to reduce government expenditure

The institute further highlighted the need for a clear policy direction from the Finance Minister on increasing government revenue as a percentage of GDP without raising taxes. Dr. Forson, during his vetting, assured Ghanaians of his commitment to achieving this goal, and the budget is expected to provide a detailed roadmap toward fulfilling this promise.

GUTA’s Position on Taxation

The Ghana Union of Traders Association (GUTA) has also weighed in on expectations for the 2025 budget. Speaking to the media, GUTA President Dr. Joseph Obeng urged the government not to introduce any new taxes. Instead, he advocated for the expansion of the tax net to capture individuals and entities currently outside the system.

“We’re not expecting new taxes. However, we won’t oppose measures aimed at bringing more people into the tax net,” Dr. Obeng stated. “What we do not support is increasing the burden on the small group of individuals and businesses already paying taxes.”

Government’s Fiscal Vision

In a press briefing following a special Cabinet meeting, Minister of Government Communications Felix Kwakye Ofosu reiterated the NDC government’s commitment to economic stabilization and sustainable growth. He assured Ghanaians that the 2025 fiscal policy will reflect the administration’s core promises, including the removal of the betting tax and the COVID levy.

Additionally, the budget will provide a detailed overview of the financial state inherited by the NDC government while laying out strategic policies aimed at fostering national development.

Conclusion

As Ghanaians await the 2025 budget presentation, the IPG, GUTA, and other stakeholders have made their expectations clear. From leveraging technology for efficient tax administration to implementing cost-cutting measures and expanding the tax net, the government faces the challenge of balancing fiscal prudence with economic growth. The budget will be a litmus test for the NDC government’s ability to address the country’s pressing economic challenges while fulfilling its promises to the people.

Story by: Mercy Addai Turkson #ahotoronline.com