Lomé, Togo – President of the Republic of Ghana, H.E. John Dramani Mahama, has called on African leaders to unite in reshaping the global narrative around the continent’s public debt, urging a collective approach grounded in courage, clarity, and commitment.

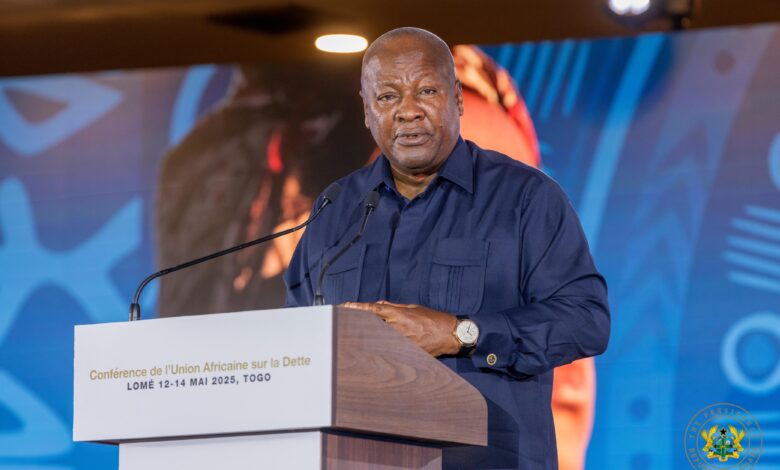

Addressing the Presidential Dialogue on Public Debt in Africa held in Lomé, Togo, on Monday, May 12, 2025, President Mahama emphasized the need for African nations to take control of the debt discourse and advocate for fairer, more sustainable financing models.

He reaffirmed Ghana’s readiness to stand shoulder to shoulder with its fellow African nations in pursuing this agenda.

“Ghana stands ready and will stand shoulder to shoulder with fellow African nations to champion the agenda,” he said.

President Mahama called for unity among African heads of state in tackling the continent’s debt challenges with a renewed sense of urgency and purpose.

“To walk this road together with courage, clarity, and commitment,” he urged.

The high-level dialogue brought together leaders and economic experts from across the continent to examine the root causes of Africa’s debt vulnerabilities and identify innovative, collaborative solutions to safeguard future growth and sovereignty.

Find below the full speech delivered by President John Mahama:

Your Excellency Faure Gnassingbé, President of the Council of Ministers of the Togolese Republic, Your Excellency João Manuel Gonçalves Lourenço, Chairperson of the African Union and President of the Republic of Angola, Excellencies, Fellow Heads of State and Government, Honourable Ministers of Finance, Governors of Central Banks, Representatives of Multilateral Institutions, Development Partners, Distinguished Guests, Ladies and Gentlemen, It is a privilege and honour to address this esteemed gathering on the critical issue of Africa’s public debt.

I wish to express my profound appreciation to His Excellency President Faure Gnassingbé, the Government, and the people of the Togolese Republic for their warm hospitality. Lomé, a city Ghanaians affectionately consider a second home, is a fitting host for this timely and consequential conversation.

I also commend the African Union Commission and its Department for Economic Development, Tourism, Trade, Industry and Minerals, as well as our development partners, for convening this High-Level Conference under the theme: “Africa’s Public Debt Management Agenda in Restoring and Safeguarding Debt Sustainability.”

This is not just a technical theme; it is a call to confront one of the most defining challenges of our generation.

I. AFRICA’S DEBT LANDSCAPE: A PARADOX OF NEED AND VULNERABILITY

Africa today stands at a crossroads. On the one hand, we are witnessing commendable progress in infrastructure development, social investment, and digital transformation.

According to the African Development Bank, Africa needs $130–170 billion annually to bridge its infrastructure gap. Yet, access to affordable, long-term finance remains elusive.

On the other hand, we are burdened by escalating debt service obligations.

In 2024 alone, African countries spent over $90 billion servicing debt—almost double the amount received in foreign aid. This is more than the combined annual public spending on health and education in many of our countries.

Recent data from the IMF reveals that 22 African countries are either in or at high risk of debt distress.

The average public debt-to-GDP ratio in sub-Saharan Africa is projected to exceed 60% in 2025, up from 40% a decade ago. Ghana, like many of our peers, has had to undergo painful restructuring to restore macroeconomic stability and rebuild investor confidence.

These facts are stark reminders that while debt can be a catalyst for transformation, it can also be a source of fiscal fragility and lost sovereignty—if not well managed.

II. GHANA’S JOURNEY: REFLECTIONS AND LESSONS

Ghana’s debt history is emblematic of the broader African experience. In the early 2000s, under the HIPC and MDRI initiatives, Ghana slashed its debt-to-GDP ratio from over 100% to under 30%. This unlocked significant fiscal space and allowed for investment in education, roads, and health care.

Between 2006 and 2015, successive governments—including mine—strategically combined concessional and non-concessional financing to accelerate infrastructure development and social inclusion. Under my administration in 2015, Ghana entered into an IMF-supported Extended Credit Facility programme to restore fiscal discipline, particularly in the energy sector.

However, in the years that followed, In a splurge of unrestrained borrowing, multiple external shocks—the COVID-19 pandemic, the global inflation surge, and commodity price volatility—pushed Ghana’s debt-to-GDP ratio went from a low of 56.3 in 2016 to a peak of 90.7% in 2022.

We faced surging borrowing costs and currency depreciation, and by 2023, interest payments alone consumed 47% of total government revenue—a level described by the World Bank as fiscally unsustainable.

In 2024, through constructive engagement under the G20 Common Framework, Ghana reached a $5.4 billion debt restructuring deal with bilateral creditors, providing essential breathing room. But the path to recovery remains complex. Our experience offers three key lessons:

1. Timely and transparent engagement with creditors matters. Delays only deepen crises.

2. Multilateral support must be flexible and aligned with domestic development priorities.

3. Sustainable debt is not just about ratios—it is about what debt finances, and the governance that underpins it.

And here we leaders of Africa must take responsibility for the debt trap we find ourselves. In Ghana , over the last several years there was an acceleration of debt accumulation, much of it going into budget support in a poor governance environment

III. A NEW DEBT AGENDA FOR AFRICA

If we are to shift from managing debt crises to unlocking debt as a tool for development, Africa must adopt a new public debt management agenda rooted in three foundational pillars:

1. Transparency and Accountability

Debt should serve the people. This means strengthening parliamentary oversight, enhancing public debt audits, and promoting open budget systems. According to the IMF, less than 40% of African countries publish detailed debt reports. We must change this.

2. Productive and Efficient Borrowing

Borrowing must be tied to high-impact projects. In Ghana, we are prioritising value-added agriculture, renewable energy, and digital infrastructure—all sectors that yield multiplier effects in jobs, exports, and innovation.

3. Regional Solidarity and Global Financial Reform

Africa must speak with one voice to push for fairer global financial rules. Credit rating agencies must adopt methodologies that reflect the structural reforms and growth potential of African economies—not just penalise us for volatility we did not create.

Let us also build the capacity of African financial institutions such as AfDB, Afreximbank, and the proposed African Monetary Fund, to offer concessional finance tailored to our realities.

IV. POLICY INNOVATIONS: WHAT IS WORKING AND WHAT MUST CHANGE

Innovation must guide our debt strategy.

• Debt-for-climate swaps can help countries finance resilience while easing repayment pressure. Barbados has led the way—Africa should follow.

• Green and blue bonds must be scaled up across the continent to finance environmental protection, clean energy, and sustainable agriculture.

Ghana is exploring these options alongside broadening the tax base, digitising revenue collection, and enhancing domestic capital markets to reduce dependency on external borrowing.

However, we must also acknowledge what is not working:

• The G20 Common Framework remains slow and creditor-driven. Of the five African countries that applied, only three have seen material progress.

• Vulture funds and aggressive litigation undermine good-faith restructuring efforts.

• SDR reallocation remains far below the 100 billion dollars pledged for Africa.

These issues demand urgent multilateral reform—and Africa must be at the table.

V. GHANA’S COMMITMENT TO RESPONSIBLE DEBT AND EQUITABLE GROWTH

Ladies and Gentlemen, Ghana is committed to rebuilding its fiscal buffers, strengthening institutions, and promoting inclusive growth. But our fiscal consolidation must not come at the cost of social protection. Our strategy includes:

Our goal is not just to reduce debt—it is to transform our economy. Debt must not erode our dignity or delay our development. It must finance opportunity and lay the foundation for intergenerational progress.

VI. A CONTINENTAL CALL TO ACTION

This moment must be a turning point—not only for Ghana but for Africa as a whole. I join my colleagues in calling for:

• A Common African Position ahead of the 2025 G20 Summit to demand timely, fair, and transparent debt restructuring frameworks

• Standardised debt transparency benchmarks across the African Union

• Integration of climate adaptation and the Sustainable Development Goals into national debt strategies

• The full operationalisation of the African Monetary Institute and the Pan-African Payment and Settlement System (PAPSS) to reduce forex burdens and strengthen regional trade

VII. CONCLUSION: REDEFINING AFRICA’S DEBT NARRATIVE

Excellencies, Distinguished Delegates, Let us leave here with a renewed vision. A vision where debt is no longer synonymous with crisis, but with capacity. Where our economies are built not on extraction and aid, but on innovation and equity. Where we act not as debtors pleading for relief, but as partners demanding reform.

Let us redefine the debt narrative. Ghana stands ready—shoulder to shoulder with fellow African nations—to champion this agenda. Let us walk this road together with courage, clarity, and commitment.

Africa, united in vision and action, can overcome its debt challenges and deliver prosperity for generations to come. I thank you for your kind attention.

Story by: Emmanuel Romeo Tetteh(#RomeoWrites